Nj Public Records Filing For New Business Entity

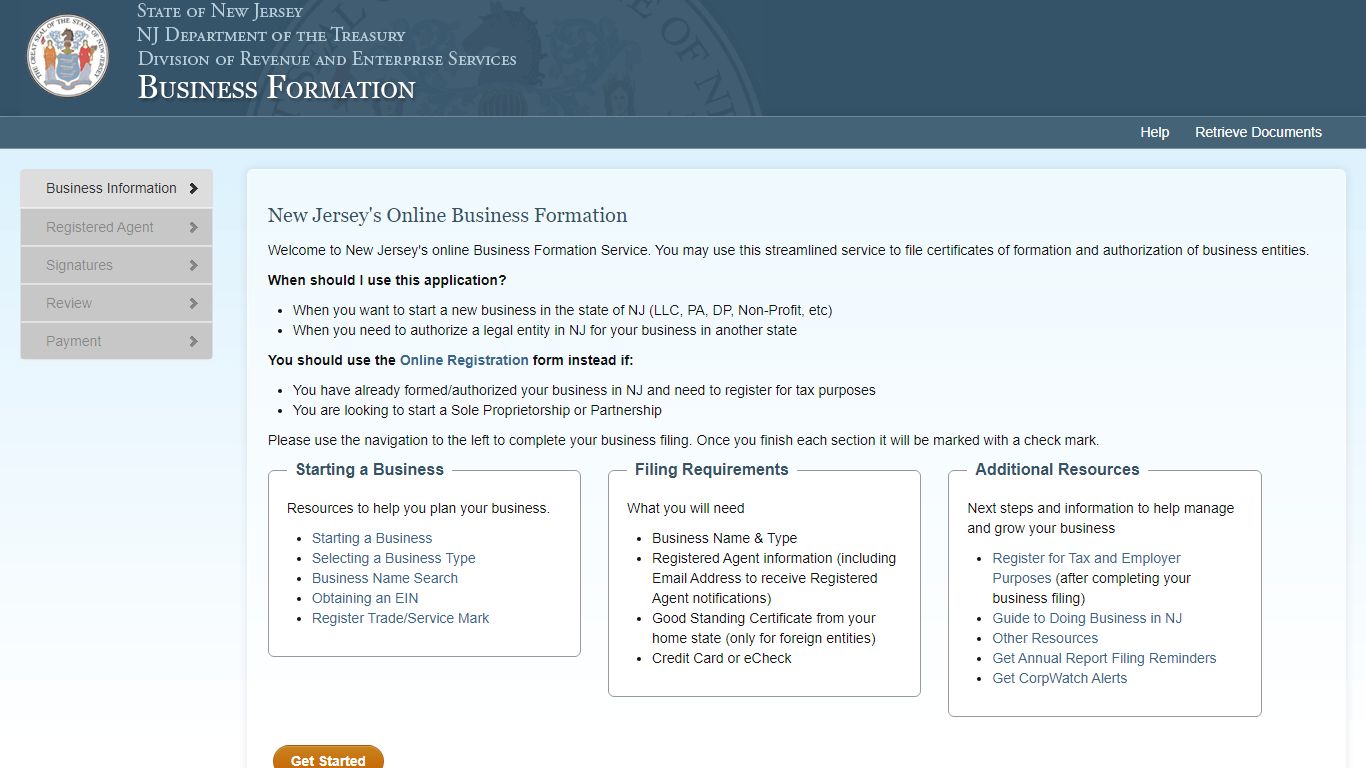

State of NJ - Online Business Entity Filing

When you want to start a new business in the state of NJ (LLC, PA, DP, Non-Profit, etc) When you need to authorize a legal entity in NJ for your business in another state You should use the Online Registration form instead if: You have already formed/authorized your business in NJ and need to register for tax purposes

https://www.njportal.com/dor/businessformation/home/welcome

Get NJ Public Records Filing for New Business Entity - US Legal Forms

Now it will take not more than thirty minutes, and you can do it from any location. The best way to fill up NJ Public Records Filing for New Business Entity fast and easy: Access the PDF sample in the editor. See the outlined fillable lines. This is where to insert your information. Click the variant to choose if you find the checkboxes.

https://www.uslegalforms.com/form-library/tax/6948-nj-public-records-filing-for-new-business-entityBusiness.NJ.gov | Register Your Business - Government of New Jersey

After you form your business, you will obtain a Certificate of Formation or Certificate of Authority which will display your Entity ID. An Entity ID is a 10-digit number used to identify your corporate business records. Your corporate records are public and kept separate from your tax records, which are confidential. Complete the Business Formation

https://nj.gov/njbusiness/registration/

Public Records Filing for New Business Entity - New Jersey Nonprofit ...

How to file the New Jersey Public Records Filing for New Business Entity To submit your Public Records Filing, you will need to file through the Department of the Treasury's online portal. There is a $75 processing fee with an additional $3.50 convenience fee when you apply online and pay by credit card. New Jersey Nonprofit Formation FAQ

https://startupsavant.com/start-a-501c3-nonprofit/new-jersey-nonprofit-articles-of-incorporation

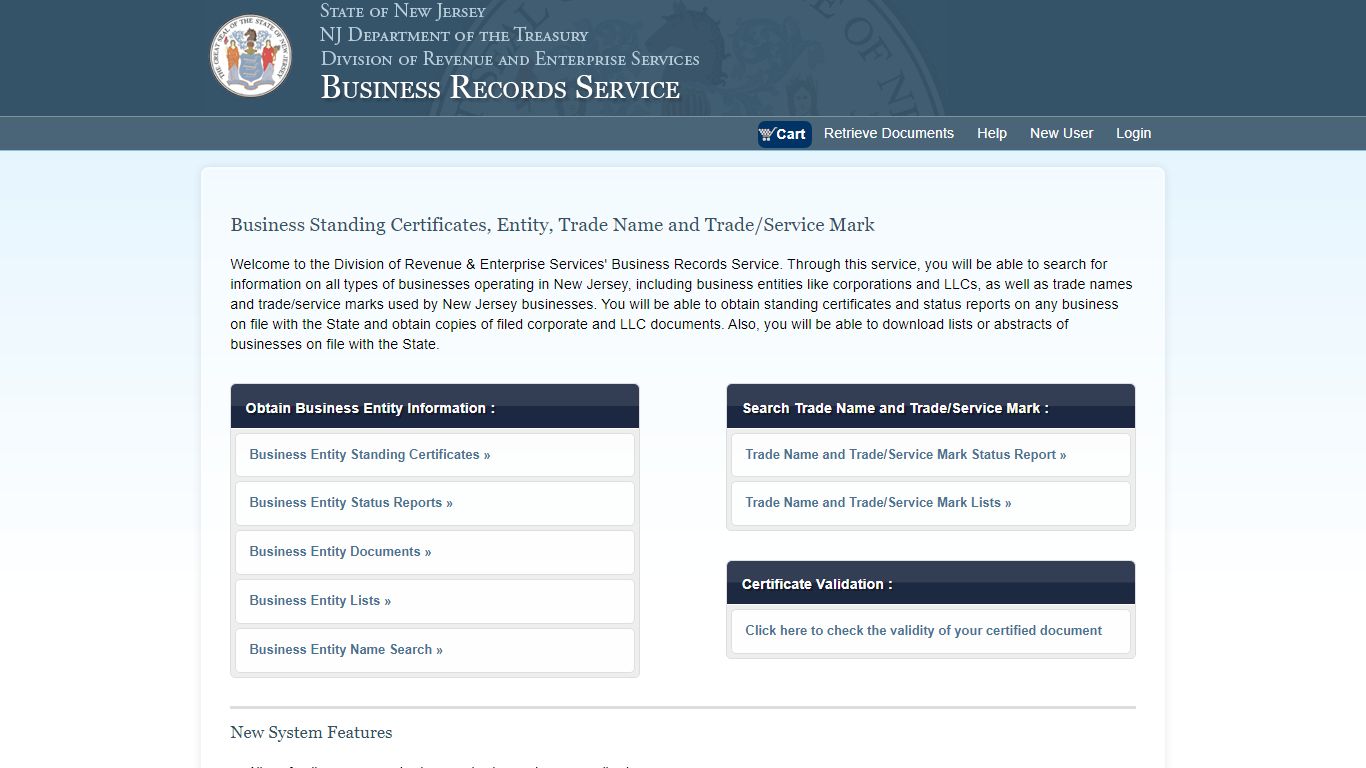

Division of Revenue & Enterprise Services: Business Records Service

Welcome to the Division of Revenue & Enterprise Services' Business Records Service. Through this service, you will be able to search for information on all types of businesses operating in New Jersey, including business entities like corporations and LLCs, as well as trade names and trade/service marks used by New Jersey businesses.

https://www.njportal.com/DOR/businessrecords/

State of NJ - NJ Treasury - DORES - Government of New Jersey

Registry Fee Schedules The statutory fees required to file, record or obtain copies of documents that are part of the public record are listed in the categories below. For-profit Corporation and Limited Partnership Filing Fees Non-profit Corporation Filing Fees Limited Liability Company Filing Fees Limited Liability Partnership Filing Fees

https://nj.gov/treasury/revenue/fees.shtml

State of NJ - NJ Treasury - DORES - Government of New Jersey

NJ Treasury Division of Revenue and Enterprise Services DORES New Business Filings Business Records and Information File Annual Report Uniform Commercial Code Notary Public Commissions Tax Filing/Payment Services Contact Us New Notary Public Law Takes Effect on October 22, 2021 Announcement – New Notary Educational and Testing Requirements

https://www.nj.gov/njbgs/

REGISTRATION FORMS AND INFORMATION - New Jersey Superior Court

You must apply for your FEIN afteryou have formed your business entity. Contact the Internal Revenue Service at 1-800-829-1040 or www.irs.gov . Questions? Please contact the Client Registration Bureau at (609) 292-9292 if you have questions regarding the filing of the Business Registration form.

https://www.njcourts.gov/public/assets/langSrvcs/njreg_kit.pdf

New Business Entity Filing - Northwest Registered Agent

Public Records Filing for New Business Entity (continued) - 24 - INSTRUCTIONS FOR BUSINESS ENTITY PUBLIC RECORD FILING GENERAL INSTRUCTIONS AND DELIVERY/RETURN OPTIONS 1. Type or machine print all Public Records Filing forms, and submit with the correct FEE amount. (See FEE schedule on page 22). 2. Choose a delivery/return option: a.

https://northwestregisteredagent.com/forms/new-jersey/foreign-llc-formation/new-jersey-foreign-llc-public-records-filing-for-new-business-entity

State of NJ - NJ Treasury - DORES - Government of New Jersey

The "Public Records Filing for New Business Entity" form must be on file before the collection agency bond application is submitted. When submitting the application, a finance statement from the surety company and an executed Power of Attorney form establishing the Attorney-in-Fact as the Surety's authorized legal representative must be attached.

https://www.nj.gov/treasury/revenue/filecollagbond.shtml

ABLE OF CONTENTS - State

you have formed your business entity. Contact the Internal Revenue Service at 1-800-829-1040 or https://www.irs.gov/. Questions? Please contact the DORES’ Customer Service Center at 609-292-9292 if you have questions regarding the filing of the Business Registration Application or the Public Records Filing for New Business Entity. -2- REG-3

https://www.state.nj.us/treasury/revenue/pdf/2000.pdf